When One Customer Loves Digitization and Another Wants a Human Connection – What’s the Right Route for Your People?

A Look at the Banking Industry’s Complex World of Customer Experience

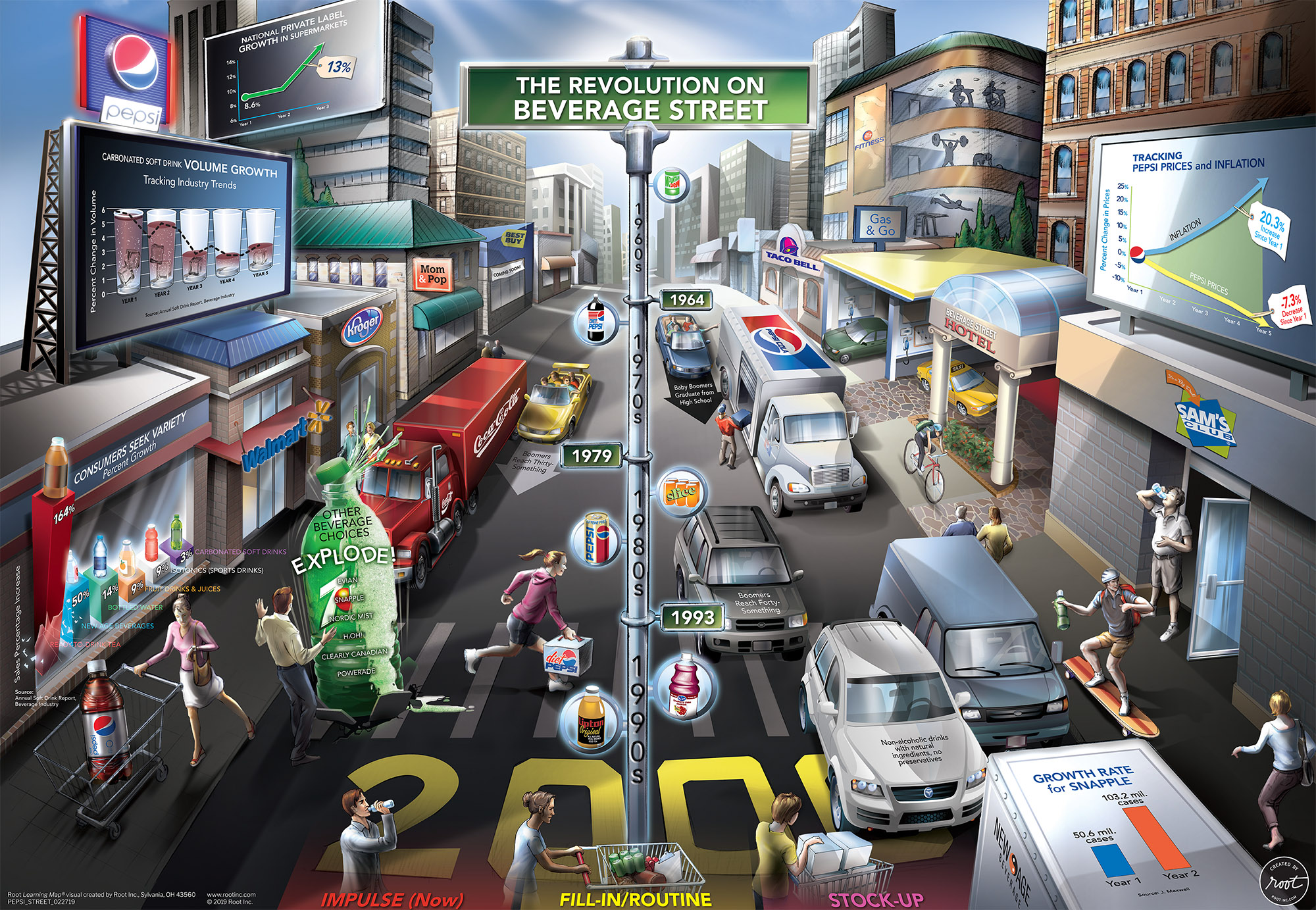

There isn’t an industry today that isn’t leveraging technology to make things easier for their customers. Whether you’re scheduling your next dentist appointment via text message, ordering dinner from an app, hitting a button to have a sales associate bring you a new size while you remain comfortably in the dressing room, scanning a QR code to see what beers are on the menu at the local brewery, or depositing a check while sitting on your sofa, technology is everywhere.

Digitization has become an invaluable element of the customer experience cycle, and beyond that has impacted most aspects of everyday life for the better – including making customer service a lot more convenient as customers have the control to do tasks themselves rather than waiting for a customer experience rep to become available to assist them. The banking industry is no exception.

When it comes to banking, the ability to conduct transactions virtually has become a must-have to many. According to the Evolution of the U.S. Neobank Market Report, 89% of U.S. respondents say they use mobile banking channels, and 70% say mobile banking has become the primary way they access their accounts.

Technology Isn't Enough

While there’s no disputing the powerful benefits that technology has delivered, sometimes customers want advice, insight, and assistance from an expert. A living one. And truthfully, sometimes only a human being with real-world experience can successfully solve an issue or guide a customer to the right decision with tact, empathy, and compassion. This is very often the case in the banking industry where customers might feel overwhelmed when making choices that impact their finances.

The reality is that both digitization and human support from employees are a must for the banking industry. There’s another reality here too – the fact that as mobility and digitization increase, the frequency of humanized experiences decreases, making each of these (fewer) human interactions dramatically more important to CX. The stakes are high, both in terms of delivering the best cutting-edge technological innovations, and of balancing this with the right amount of human interaction.

Supporting Employees During Digitization: Three Tips to Follow

As banks and organizations across other industries work to leverage technology innovations that meet the needs of consumers seeking the convenience of virtual experiences, we can’t let our focus on employees lessen. Yes, mobility and digitization should be critical, centerpiece elements to every business strategy, but that doesn’t decrease the importance of the employee experience. In fact, it amplifies it.

We all know customer experience cannot exceed employee experience. To ensure your people aren’t overshadowed by the latest mind-blowing tool you’re launching, it’s time to revisit some core employee experience strategies that have been proven to improve employee engagement and satisfaction, both of which will also do wonders for your CX.

Foster relationships between employees.

Your culture is more important than ever. You might have decreased the number of employees in your workforce because you now have an intelligent bot that can answer a large percentage of your incoming calls and have built amazing self-serve options for customers, but this doesn’t mean you can cut the effort spent cultivating your culture. In fact, you need to invest more time ensuring that your people connect to their leaders, their peers, and other areas of the business. Effort put behind connecting people is more critical in today’s world, where many people opt to work remotely or on a hybrid schedule.

The BBC article “Why Your In-Office Friendships Still Matter” discusses this topic and reports that there is “a direct link between productivity and social connection” and that “a sense of belonging among your colleagues makes you better at your job.” Whether your organization has adopted remote, hybrid, or in-person work, the end point is the same – people who feel allegiance to their peers work harder and more cohesively. And you need this from your employees more than ever.

Connect people to your strategy and your purpose.

Every employee must feel connected to the strategy and purpose of your business. They need to understand – from a big picture perspective – why new technologies are being put into play, and they must be reminded that they still play a critical role in helping their organization achieve success. They need to understand that they are part of a bigger journey, and it’s only together that the goal can be achieved. When people see the whole organization working together to reach an important milestone or goal, and they feel connected to the whole, they will work harder to ensure they play their part and don’t let anyone down.

Put new focus into knowledge and development

Your employees need knowledge, support, and recognition to feel fulfilled. If you aren’t investing the time and dollars into helping your people grow to their full potential, the money you’re investing in technology won’t achieve its entire value either. As technology becomes more prevalent, and there are fewer people interacting with customers, the remaining human experiences are heightened in importance. This means your people need more skills and knowledge, as they have more pressure on them too. And if people need extra training and development on how to better serve customers in a post-pandemic world, then you’d better be figuring out a plan to deliver this to them.

Humans Should Never Be Removed from the CX Equation

No matter how amazing your self-service tools are, how accurate your AI bots are, or how intuitive it is for your customers to make deposits, obtain their latest account transactions and balance, or choose which type of account to open next, your people are invaluable. They’re the differentiator that no competitor can emulate. In the end, humans are needed to appease the most unhappy of customers, fix tech glitches, and provide personalized empathy and attention that no machine can deliver.

Building the Right Tech-Savvy + Human-Focused CX Strategy

When it comes to ensuring your bank has the right mix of innovative services and human support, your leadership team needs to be aligned and working together. Without a sound plan, customers won’t have access to the right mix, and exceptional CX is nothing but a pipe dream. Here are a few tips to help leadership teams ensure they are building a plan with the right mix of self-service, tech-focused options, and human interaction.

Ensure Leaders are Aligned

Be sure to discuss not only the destination, but also the plan to get there. Leadership teams can be very good at gaining consensus on a broad idea of a future state, but they have a tendency to put off discussions about details and prioritization. Have hard, tactical conversations up front. Not only will this create a stronger, more consistent vision of the strategy, but it will also flatten any speed bumps and disruptions that pop up later.

Change the Conversation at All Levels

All too often, companies have a tendency to communicate strategies as one-way directives. “We decided to do this, which means you need to do that.” This rarely works out well, as human behavior naturally resists being instructed to change. Encourage a peer-to-peer dialogue about the factors leading to these decisions. Bring people “under the tent” and help them realize for themselves why digitization or stronger focus on meeting customer expectations makes sense. Don’t shy away from talking about competition, new customer expectations, economic volatility, or any of the other factors leading you down this path. Supply your people with the same data the leaders used when they created the strategy, and trust that they’ll come to the same conclusions.

Sustain the Momentum

Creating initial awareness and excitement about a digital transformation is the easy part, as the allure of cutting-edge technology is often fun and exciting. But most companies tend to overestimate people’s ability to immediately change, and underestimate the amount of effort needed to permanently shift thoughts, feelings, and actions. Focus on your managers and people leaders. Empower them to empower their people to act like owners. Make sure they know how their respective teams fit into making it all work, and what they need to say and do to inspire and motivate their people.

Never Stop Pursing the Right Tech & Human Touch Balance

To succeed in a world where people and technology coexist, employees must be core to the CX strategy. It can’t be technology first and employees second. If employees are part of the journey, and are provided the why, how, and when behind the strategy, employees will reap the benefits just as much as end users. They’ll welcome the smart bots and digital tools that offset some of their mundane tasks. They’ll be thankful for the greater bandwidth to address customers’ bigger challenges. It’s a true win-win scenario in which employees, customers, and banking institutions all benefit.

From the banking industry to all businesses around the globe, organizations must ensure their mobility and digital offerings are intuitive and user-friendly. But that’s not enough. Businesses must arm their employees with the confidence, knowledge, and support to deliver the person-to-person interactions that have every customer recommending your bank to their friends and families, and every employee committed to working for your brand for the long term too.